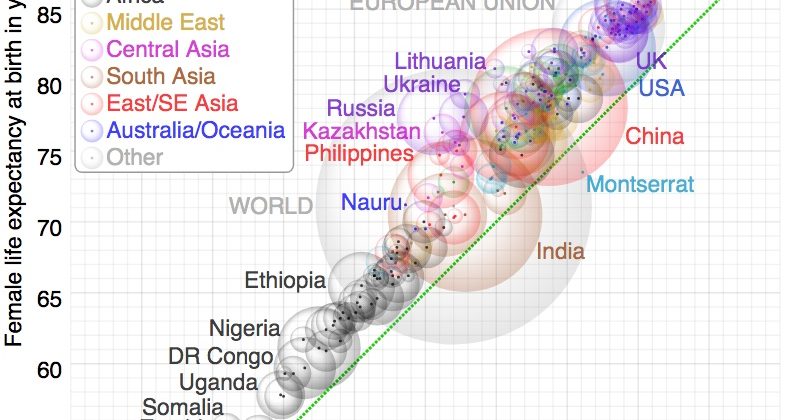

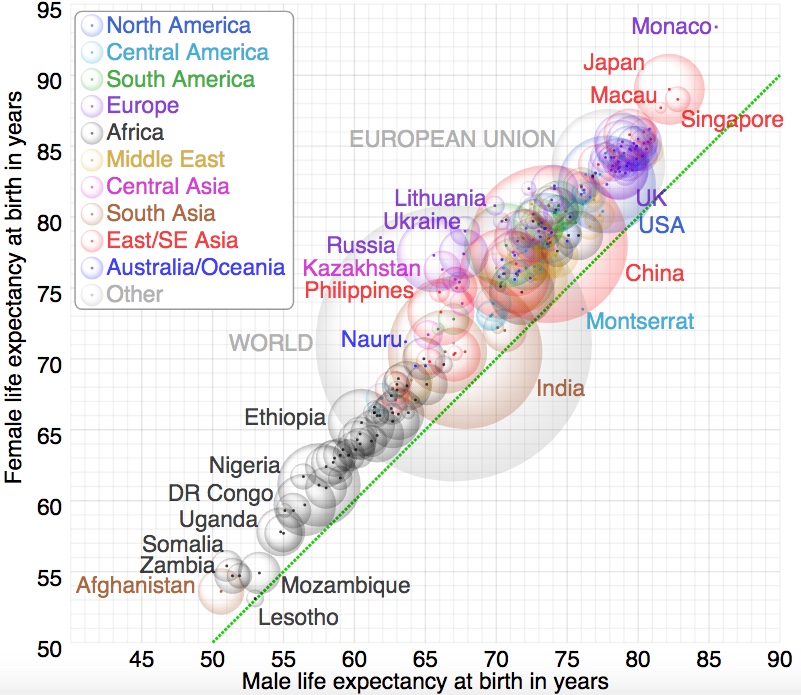

Longevity is sometimes called lifespan and indicates the length of life in years a person can expect to live. Needless to say, many variables go into this calculation, but it is often used by governments, insurance companies, and healthcare providers, for projections, risk analysis, and benefits. Be aware that these are averages you see in reports and research, just take a look at this interactive chart based on 2011 data. That data hasn’t changed much either way since then. BTW, my wife and I are moving to Monaco!

So why is it something we need to think about? Retirement, money, and health. Depending on where you live, retirement may be as young as 55, from a company position. Many others officially retire at 65. Some work beyond that age, either part-time or volunteering for organizations until age catches up to them.

Once you retire, you are living off investments made before retirement, unless you had a rich relative that left a bunch of money to you. That length is longevity, and those funds determine what kind of lifestyle you will have.

Your health will also determine how you live once retired. Diet and exercise are vital determinants of not only how long you live but how well. If you didn’t stop drinking and eating as you did in college until your 50’s or 60’s, chances are you’ll end up with a shorter lifespan. If you ate healthily and exercised often, you will most likely live longer. I make no judgments about your choices.

The funny thing about averages

You may recall from elementary school math that an average takes all numbers and divides that by the count of those numbers. The problem, and opportunity, is that there are extremes on both ends that drag that number up or down. For example, in the U.S., there have been a high number of deaths to opioids that it brought the average life span down for the last several years, although they are starting to turn around. Every country has similar statistics for deaths associated with the use of drugs. Younger people are dying at an alarming rate due to opioids and suicide.

Poverty is another factor in the average life span. Low income means a less healthy diet and access to healthcare. Many governments and NGOs are addressing this, but the sheer size and scope is a challenge. Air quality As you can see, there are many factors to consider.

What brings the average number up is living longer due to better health, eating, exercising, and better healthcare. For some, this is hard to do, while others can eat healthier and exercise frequently. Some of this is based on where you were born; in other cases, it can be social mobility. Read this article and understand just how lucky you are.

More people have now lived beyond 100 than ever before in history, with Japan leading the way with over 70,000! Pew Research quotes a statistic from the medical journal The Lancet that more than half the children born now in developed countries will reach the age of 100. More than half! Are you ready for that? Are businesses prepared for that? What about governments that pay out social security or pensions when people retire? What impact will that have on the economy? My guess is it will have a pretty significant impact on just about everything.

What to do

Certain things cannot be changed, or at least are very difficult to change. Multi-generational poverty is difficult to break, even with many trying to help. Chronic diseases are also difficult to change, especially with multiple conditions or being born with one. Medical advances addressing these issues coming out every day, and more are on the way. Sickle Cell Anemia is an example.

If you are relatively healthy now, keeping fit is becoming easier. There are more food choices available than ever that have a positive impact on your health. Reducing caloric intake and exercise is something every doctor will tell patients; 30 minutes three-to-four times a week has a positive effect. Reducing alcohol, medications, and stress is good as well. Many have taken this to heart, keep up the excellent work, and help others realize the benefits as well.

Plan earlier. Knowing now that when you retire at 65, your life expectancy is 30 or 40 years makes a significant impact on your financial abilities. Fifteen-year estimates for spending after retirement are in the $25,000 to $325,000 range. You’ll need to think about doubling that if you expect to live into your 90’s. Typically, people will be spending the most money five years before retirement. You might want to think about cutting that back before you reach that time.

Impacts will be far and wide

Governments need to take up the challenge of determining how to pay for retirement benefits when people are living much longer. Funding comes from taxes, and almost every country in the world is not replacing their indigenous population to be taxed and pay for those benefits of their older people. Many are looking to immigration as a solution, but serious issues are being raised with that policy.

Healthcare will need to consider how it will be provided to an ever-expanding population of older patients with chronic conditions. As the Boomer population in the U.S. starts to hit their mid-80’s costs will go up to treat and manage their health. Technology will account for some of this, especially in the areas of therapies and immunology. That just brings us back to who pays for these treatments.

Just for fun

Below are some sites that will calculate your life expectancy. Use them at your own risk, we take no responsibility for emotional responses, positive or negative. Remember, these sites are using averages, so think through the results. Also, consider that they use different risk and calculation models so you may not get the same results between them. So, just average them!

U.S. Social Security Administration Life Expectancy Calculator.

Blueprint Income How Long Will I Live?

Robert Wood Johnson Foundation, “Could where you live influence how long you live?” (U.S. only)

Would you want to know the date you expire ahead of time or not? Would you change anything in your life if you did know? What would you change?