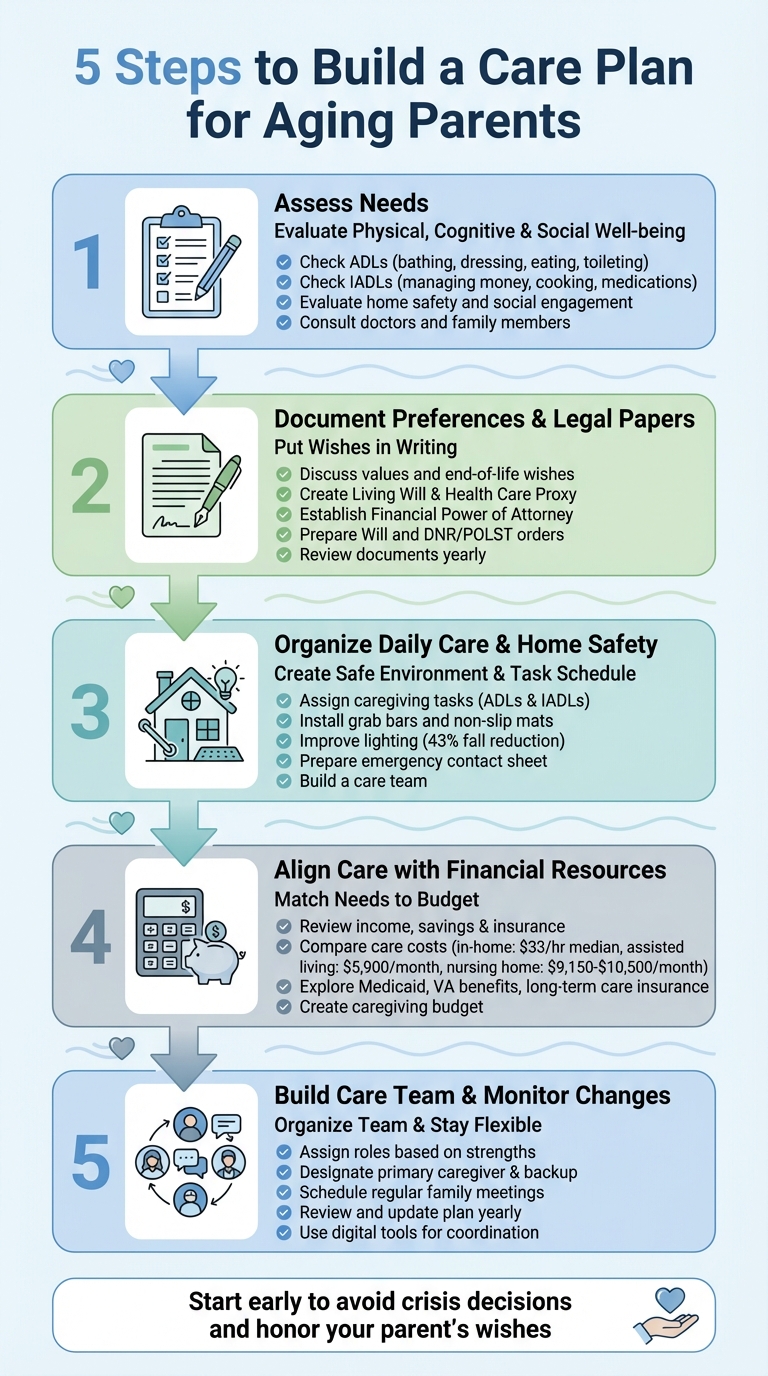

When caring for aging parents, having a clear plan can ease stress, improve care, and prevent last-minute decision-making. This guide outlines five steps to create a care plan that addresses health, daily needs, finances, and family involvement:

- Assess Needs: Evaluate your parent’s physical, cognitive, and social well-being. Identify challenges with daily activities like bathing, cooking, or managing medications.

- Document Preferences & Legal Papers: Discuss their wishes for medical care and end-of-life decisions. Ensure key documents like wills, power of attorney, and advance directives are in place.

- Organize Daily Care & Home Safety: Assign caregiving tasks, improve home safety (e.g., grab bars, non-slip mats), and prepare emergency contacts.

- Align Care with Financial Resources: Review income, savings, and insurance. Plan for care costs, whether in-home or facility-based, and explore options like Medicaid or long-term care insurance.

- Build a Care Team & Monitor Changes: Assign roles to family members, schedule regular updates, and adjust the plan as your parent’s needs evolve.

Start early to avoid stress during emergencies and ensure your parent’s preferences are respected. By addressing these steps, you can provide better care while sharing responsibilities with others.

5 Steps to Build a Care Plan for Aging Parents

Understanding Elderly Parents’ Needs Through Care Assessments So You Know What You’re Dealing With

sbb-itb-48c2a85

Step 1: Assess Your Parent’s Current Needs

Start by evaluating your parent’s physical abilities, cognitive health, home safety, and social connections to identify areas where they may need support.

Check Activities of Daily Living (ADLs) and Instrumental ADLs (IADLs)

Activities of Daily Living (ADLs) involve essential self-care tasks like bathing, dressing, eating, using the toilet, and safely moving around (e.g., getting in and out of bed or a chair). If your parent struggles with these tasks, such as needing help to shower or dress, it’s a clear sign they may require hands-on care.

Instrumental Activities of Daily Living (IADLs) are more advanced tasks that support independent living. These include managing finances, taking medications on schedule, preparing meals, handling housework, using the phone, shopping, and attending appointments. For example, if your parent forgets to pay bills or leaves expired food in the fridge, they might need help with organization and planning, even if they handle basic self-care on their own.

| Type | Focus | Examples |

|---|---|---|

| ADLs | Basic self-care tasks | Bathing, dressing, eating, toileting |

| IADLs | Tasks for maintaining independence | Managing money, cooking, taking medications |

Evaluate Health, Safety, and Social Engagement

Take a close look at your parent’s living environment. Are there fall hazards like loose rugs, dim lighting, or cluttered spaces? Check their refrigerator for expired or spoiled food, which could indicate difficulty managing daily responsibilities. Also, watch for unexplained bruises, which might hint at undetected falls.

Beyond their physical surroundings, consider their health and medical needs. Are they staying on top of doctor visits and prescriptions? Don’t overlook their social life – are they still connecting with friends, attending events, or engaging in hobbies? Loneliness can lead to faster cognitive decline and depression, so staying socially active is just as critical as ensuring physical safety.

Gather Input from Various Sources

Consult your parent’s primary care doctor or a geriatric specialist about any ongoing health concerns or cognitive issues. Medicare even covers appointments specifically for advanced care planning and memory assessments – these sessions can provide valuable insights.

Talk to family members, neighbors, and friends who see your parent regularly. They might notice changes you miss if your visits are infrequent. You can also contact your local Area Agency on Aging for a free in-home assessment, or hire an occupational therapist to assess home safety and suggest modifications. As Tina Sadarangani, a geriatric nurse practitioner, explains:

"Planning ahead for a parent’s care as they age is crucial because it helps ensure they receive the right kind of support at the right time and reduces the likelihood of making rushed or emotionally charged decisions during a crisis."

Gathering this input will help you document your parent’s preferences and ensure their legal and care arrangements are in place.

Step 2: Document Preferences and Legal Papers

Once you’ve assessed your parent’s current needs, the next step is to put their wishes in writing and ensure all the necessary legal documents are in order. This step is crucial for preserving their independence and avoiding family disputes during medical emergencies or end-of-life situations.

Talk About Values and Wishes

Start these conversations early – long before a crisis arises. Waiting until a health emergency occurs can limit your parent’s ability to actively shape their care decisions.

Approach the topic in a way that feels natural and collaborative. For instance, you could share your own plans for end-of-life care or reference a news story about a family disagreement over medical decisions. Caregiving consultant Carol Bradley Bursack advises, "Let’s just handle all of this and then get on with the business of living." Asking open-ended questions like, "Who would you trust to make decisions if you couldn’t speak for yourself?" or "What worries you most about aging?" can make the conversation flow more easily.

If your parent is hesitant, start small by discussing temporary scenarios. For example, talk about planning for a short-term recovery, which can make discussions about long-term care feel less intimidating. Another approach is to complete your own legal documents first and then review them together. This can often inspire your parent to consider their own plans.

Once their values and preferences are clear, it’s time to formalize those wishes with the right legal paperwork.

Check Key Legal Documents

Turning these conversations into actionable plans means creating the right legal documents. Begin with Advance Directives, such as a Living Will and a Durable Power of Attorney for Health Care. These documents ensure medical decisions align with your parent’s wishes if they’re unable to speak for themselves. Research shows that when preferences aren’t documented, people guess wrong on about one in three end-of-life decisions. Proper documentation removes the guesswork during critical moments.

In addition to medical directives, make sure your parent has a Durable Power of Attorney for Finances. This document gives someone the authority to handle bank accounts, real estate, and government benefits if your parent becomes incapacitated. A Will specifies how assets should be distributed after death, while a Living Trust allows a trustee to manage assets if your parent can no longer do so. For emergency medical situations, specific orders like Do Not Resuscitate (DNR) or Physician Orders for Life-Sustaining Treatment (POLST) provide clear instructions to first responders.

| Document | Purpose | When It Takes Effect |

|---|---|---|

| Living Will | Details medical treatment preferences | When the person is incapacitated |

| Health Care Proxy | Names someone to make medical decisions | When the person is incapacitated |

| Financial DPOA | Authorizes control over finances and property | Immediately or upon incapacitation |

| Will | Outlines asset distribution after death | Upon death |

It’s a good idea to review these documents yearly or after major life changes, such as a move, divorce, or significant health shift. Many states provide free advance directive forms through resources like the State Attorney General’s Office, Area Agencies on Aging, or AARP. If your parent lives or spends time in multiple states, confirm that their documents are valid in each location, as laws can differ.

Compile Contact Information and Store Documents

Make a list of important contacts, including lawyers, financial advisors, doctors, insurance agents, and trusted family members. Store the original documents in a secure safe, and keep password-protected digital copies for easy access. Share copies with the designated power of attorney, doctors, hospitals, and key family members.

For emergencies, consider saving digital versions on your smartphone. Ensure the Health Care Proxy includes specific HIPAA language so the designated agent can access confidential medical records. Whether physical or digital, keep these documents in secure but easily accessible locations.

For more detailed guidance on legal and end-of-life planning, check out the ElderHonor Toolkit (https://elderhonor.com). This resource offers educational modules to help navigate estate management and care planning.

Step 3: Plan Daily Care Tasks and Home Safety

Once you’ve assessed your parent’s needs and documented their preferences, it’s time to create a daily care plan that organizes tasks and ensures their home is as safe as possible.

Organize Tasks by Category

Start by breaking caregiving responsibilities into two main groups: Activities of Daily Living (ADLs) and Instrumental ADLs (IADLs). ADLs include essentials like bathing, dressing, and eating, while IADLs cover tasks such as meal prep, transportation, and managing medications. Clearly outline who will handle each task and when, to avoid any confusion.

"I think of a family caregiver as the general contractor. They don’t do all the work themselves – they can’t – it’s too much for one person." – Leslie Fuller, Senior Living Expert and Author

Build a care team that includes family, neighbors, and professional aides. Assign roles based on each person’s strengths, availability, proximity, and skills. Tools like digital calendars or caregiving apps can help with scheduling, arranging backup coverage, and planning caregiver breaks. Once tasks are organized, focus on making the home environment safer.

Make the Home Safer

Falls are a major concern, accounting for over 60% of accidents among elderly individuals at home, with 80% of fall-related injuries happening in residential settings. Bathrooms are especially risky. To reduce hazards, install grab bars near toilets and in showers, use non-slip mats or adhesive strips, and consider a raised toilet seat or a walk-in shower with a bench.

Improve visibility by upgrading to brighter, motion-sensor LED lighting, particularly in hallways and bathrooms. Studies suggest better lighting can reduce falls by 43%. Adding bright-colored, non-skid tape to stair edges can aid depth perception, while securing or removing area rugs and replacing high-pile carpets with low-pile or slip-resistant flooring adds another layer of safety.

In the kitchen, place frequently used items on lower shelves and swap out round doorknobs for lever-style handles, which are easier to grip. For parents with memory issues, consider installing automatic stove shut-off devices and medication dispensers with alerts. Adjust the hot water heater to a maximum of 120°F (110°F is even safer) to avoid accidental burns. Equip the home with smoke and carbon monoxide detectors on every level and in each bedroom. For those with hearing loss, choose models with strobe lights.

Set Up Emergency Information

Prepare an emergency contact sheet that includes your parent’s basic details, medications, allergies, and preferred hospital. List phone numbers for close relatives, doctors, specialists, lawyers, and insurance agents. Keep copies of health insurance cards, advance directives, and DNR orders alongside this sheet.

Store the originals in a fireproof safe and save digital copies in a designated folder. Update this information annually or after major health changes. Make sure at least one trusted person knows where to find these documents, and complete any necessary permission forms in advance so healthcare providers and insurers can communicate with you during emergencies.

Step 4: Match Care Needs with Financial Resources

Once you’ve outlined daily tasks and ensured home safety, the next step is connecting your parent’s care needs to their financial resources. This is about aligning the care plan with the funds available to make it all work.

Review Income, Savings, and Insurance

Start by calculating your parent’s monthly cash flow. Add up all income sources – Social Security, pensions, 401(k) or IRA withdrawals, rental income, and dividends. Then, list their monthly expenses: housing costs, utilities, groceries, medications, insurance premiums, and transportation. The difference between income and expenses reveals whether they can cover basic living costs before factoring in care expenses.

Next, assess their assets and liabilities. Include real estate, savings accounts, vehicles, and any life insurance policies with cash value. Subtract debts like mortgages, credit card balances, or outstanding loans. This gives you a clear picture of available resources, should you need to dip into savings or sell assets to fund care.

"A care plan is thinking through the logistics of what you’re going to need as you age, so that when the poop hits the fan with aging, then you are prepared." – Carolyn McClanahan, Certified Financial Planner and Physician, Life Planning Partners

Insurance coverage is another key piece of the puzzle. While Medicare handles hospital stays and doctor visits, it doesn’t cover long-term custodial care. Medicaid, on the other hand, provides extensive long-term care for those who qualify. If your parent has long-term care insurance, review the policy to understand what services are covered and any benefit limits. Veterans should also check eligibility for VA benefits, which may include long-term care at home or in facilities. Free tools like the National Council on Aging‘s BenefitsCheckUp or the State Health Insurance Assistance Program (SHIP) can help identify programs your parent might qualify for.

Compare Care Settings and Their Costs

The cost of care varies widely depending on the type and location of services. For example, in-home care costs a national median of $33 per hour in 2025, though this rate fluctuates by state – ranging from $24 per hour in Mississippi to $43 per hour in Minnesota and South Dakota. To estimate monthly costs, multiply your local hourly rate by the expected weekly hours of care.

| Weekly Hours | Support Level | Monthly Cost Estimate at $33/hour |

|---|---|---|

| 7 hours | Light support (daily check-ins) | ~$1,000 |

| 15 hours | Daily check-ins and errands | ~$2,145 |

| 30 hours | Part-time support | ~$4,290 |

| 44 hours | Full-time support | ~$6,292 |

In-home care, which includes help with meals, cleaning, and companionship, is typically paid out of pocket. However, home health care – such as skilled nursing or physical therapy – might be covered by Medicare or insurance if a doctor prescribes it. Don’t forget to budget for one-time costs like home modifications (e.g., ramps, grab bars, walk-in showers) and ongoing expenses for medical equipment.

For parents requiring constant supervision, facility-based care may be more economical than 24/7 in-home help. Assisted living facilities cost a median of $5,900 per month, while nursing homes charge around $305 per day (approximately $9,150 per month) for a semi-private room or $350 per day (about $10,500 per month) for a private room. The Genworth Cost of Care Survey calculator can provide tailored cost estimates based on your zip code.

"There’s evidence that even small amounts of in-home care, such as helping someone with meals or light housekeeping, can extend their independence." – Vicki Demirozu, Founder, Giving Care with Grace

Build a Caregiving Budget

Now, it’s time to create a caregiving budget that covers all expenses. If your parent’s income falls short, consider which assets could be liquidated or whether family members can contribute. On average, family caregivers spend $7,000 to $13,000 out of pocket annually to support their loved ones, with about 68% contributing their own money toward these costs.

A personal care agreement can help formalize family contributions. This written contract compensates a family caregiver at a reasonable hourly rate. Such agreements not only ensure fair compensation for caregivers – who provide an average of 23.7 hours of care per week – but can also help “spend down” assets to qualify for Medicaid. Consult an elder law attorney or financial planner to ensure the agreement complies with legal and tax requirements.

For parents who wish to age in place but lack liquid cash, a reverse mortgage can convert home equity into funds for care without requiring a move. Other options include tapping into life insurance policies through accelerated death benefit riders, which allow access to funds for long-term care while the policyholder is still alive. Keep track of all medical expenses related to Activities of Daily Living (ADLs), as these may be tax-deductible if they exceed 7.5% of adjusted gross income.

ElderHonor’s Toolkit (https://elderhonor.com) offers practical worksheets to help integrate these financial considerations into your overall care plan. By planning ahead and exploring all funding options – from government programs to family agreements – you can create a solid financial strategy to support your parent’s care needs.

Step 5: Organize Your Care Team and Track Changes

Once you’ve tackled care needs and financial planning, the next step is to assemble and fine-tune your care team. This step builds on everything you’ve done so far – assessments, documentation, daily care tasks, and budgeting – to create a system that keeps everyone aligned and adaptable. Many caregivers juggle responsibilities for aging parents while raising children, so having a clear structure and regular updates can help avoid burnout and ensure everyone stays on the same page.

Assign Roles and Responsibilities

Start by meeting with your parent and potential caregivers to discuss their current and future needs. Designate a primary caregiver – often the person living nearest your parent – to handle day-to-day care and act as the main point of contact in emergencies. Then, divide tasks based on each person’s strengths. For example:

- Who’s tech-savvy and comfortable with apps?

- Who communicates well with doctors and medical staff?

- Who’s good with numbers and can manage bills or insurance?

- Who provides strong emotional support?

Document these roles in a shared digital tool to centralize information like appointments, medical records, and financial details. This helps ensure everyone has access to the same data. It’s also wise to name a backup caregiver in case the primary caregiver becomes unavailable.

| Role Type | Best Suited For | Typical Tasks |

|---|---|---|

| Primary Caregiver | Local family/friends | Daily care, local appointments, emergencies |

| Financial/Legal Lead | Detail-oriented individuals | Bills, insurance, legal documents |

| Information Coordinator | Tech-savvy communicators | Managing updates, group texts, or apps |

| Long-Distance Caregiver | Remote family members | Research, emotional support, financial help |

| Respite Provider | Occasional helpers | Giving the primary caregiver a break |

Once roles are assigned, keep the team connected through regular communication and check-ins.

Schedule Regular Family Meetings

Regular family meetings are essential for sharing updates, tackling challenges, and refining roles. These discussions are much easier to manage if they happen before emergencies arise. Include your parent, family members, friends, and, when needed, professional caregivers like social workers or elder law attorneys.

Prepare for these meetings by sharing an agenda that outlines the goals, topics, and expected duration. Distribute an updated care plan draft ahead of time so participants can review it. Appoint a neutral facilitator to guide the conversation and someone to take notes. For those unable to attend in person, set up video conferencing. Between meetings, keep everyone informed through shared digital tools like calendars or apps.

Review and Update the Plan

Care needs can change quickly – health issues, accidents, or new diagnoses can shift priorities overnight. Update the care plan at least once a year, or sooner if major changes occur. Keeping the plan current not only helps manage chronic conditions like Alzheimer’s but also reduces the likelihood of emergency room visits or hospitalizations.

Use digital tools to provide real-time updates to the team and store electronic copies of medical histories and medication lists for quick access during appointments or emergencies. During reviews, work together to create a backup plan for short-term emergencies (like a caregiver getting sick) and long-term changes in your parent’s condition. A flexible team and regular updates ensure your parent’s care stays consistent as their needs evolve.

"If you’re in the habit of looking two steps ahead, it can provide a sense of control, and confidence that you’re prepared. That you can pivot if a twist or curve comes up." – Leslie Fuller, Senior Living Expert and Owner, Inspired Senior Care

For additional support, check out ElderHonor’s Toolkit (https://elderhonor.com), which offers worksheets and assessments to help you organize your care team and track changes. By defining clear roles and committing to regular updates, you can shift caregiving from being a reactive scramble to a thoughtful, forward-looking process.

Conclusion: Start Planning Today

As parents age, the chances of needing assistance with daily activities increase significantly, making early planning essential to honor their wishes. With over 50 million Americans already aged 65 or older, the pressing question is: Are you ready?

The five steps – evaluating needs, documenting preferences, mapping out responsibilities, aligning finances, and building a care team – serve as a practical guide to avoid last-minute decisions. By tackling these steps early, you can sidestep the chaos of health emergencies, minimize family disagreements, and even make proactive changes, like modifying the home, before an unexpected fall or diagnosis forces urgent action.

You don’t have to go through this alone. Engaging family members creates a shared effort, helping to prevent caregiver burnout. Professional tools and resources can also bring clarity to the process. For instance, ElderHonor’s Toolkit (https://elderhonor.com) provides helpful assessments and worksheets, covering everything from initiating tough conversations to estate planning. These tools can help you shift from reactive stress to confident, informed decision-making.

Starting the conversation may feel awkward, but taking small, manageable steps can make the process less daunting. Including your parents in these discussions ensures their voice and preferences remain at the heart of every decision.

FAQs

How do I talk to my aging parents about their care preferences?

Starting a conversation with your parents about their care preferences can feel daunting, but it’s easier when approached with kindness and understanding. Pick a calm, private time when everyone feels at ease – maybe after dinner or during a quiet moment on the weekend. Start by sharing your concern and love, saying something like, “I want to make sure we’re ready for whatever lies ahead.”

Use open-ended questions to gently explore their thoughts and priorities. For example, you might ask, “What matters most to you as you grow older?” or “How do you feel about staying at home compared to other possibilities?” As they share, listen carefully, reflect on what they say, and acknowledge their feelings. This thoughtful approach can foster a meaningful conversation where they feel valued and understood.

What are the best ways to manage the costs of elder care?

Covering elder care expenses often requires weaving together personal savings, government assistance, and private insurance. Families usually begin by tapping into personal resources like savings accounts, retirement funds, or home equity to cover costs for in-home care, assisted living, or nursing home facilities. With monthly care expenses ranging from $6,000 to $11,000 or more, many also rely on programs like Medicaid (available to qualifying low-income seniors) or veterans’ benefits. Additionally, some families turn to long-term care insurance to help manage these significant costs.

One key detail to keep in mind: Medicare generally does not pay for long-term or custodial care, making early planning a must. ElderHonor provides a caregiving toolkit designed to help families budget effectively, navigate government programs, and explore insurance options. By starting the planning process early, you can ease financial pressures and ensure your loved ones receive the care they deserve.

How can I ensure my parents’ legal documents, like wills and power of attorney, are valid across state lines?

To make sure legal documents like wills and powers of attorney (POA) hold up across state lines, it’s important to begin with the signing and witnessing rules of the state where the document is created. Many states follow the Uniform Power of Attorney Act (UPOAA), which outlines standards for durability, required wording, and notarization. Using a statutory or state-specific form that meets these guidelines, signing it in front of a notary and witnesses, and storing it securely can increase the likelihood of its acceptance in other states.

For wills, ensure they comply with the signing and witnessing requirements of the state where they’re executed. Adding a self-proving affidavit can make it easier for courts to accept the will without needing witness testimony. If your parents own property in more than one state, you might choose to draft a single will that adheres to the strictest state laws or create separate wills tailored to each state’s property laws. Keeping the most recent versions of these documents in a safe yet accessible place is equally important.

The ElderHonor Toolkit provides useful resources and guidance to help you understand state-specific estate planning requirements, giving you peace of mind that your parents’ documents will be valid wherever they’re needed.